The recently released 2023 InsTech Insurance Innovation Member Survey offers valuable insights into the opportunities and challenges facing the InsurTech sector. In this blog post, we'll explore the survey's key findings and discuss how the insurance industry can leverage these insights to shape the future of insurance technology.

Key Insights from the Survey

The 2023 InsTech Insurance Innovation Member Survey has identified several areas of opportunity and challenge within the insurance technology landscape. Key insights include:

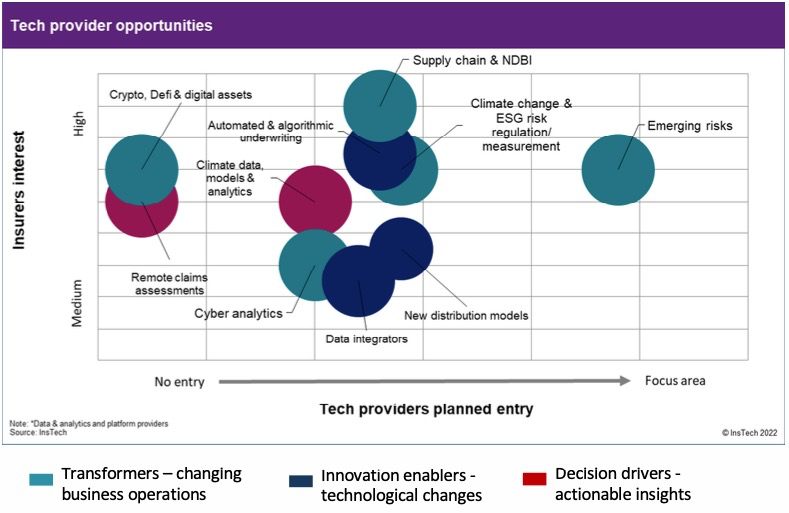

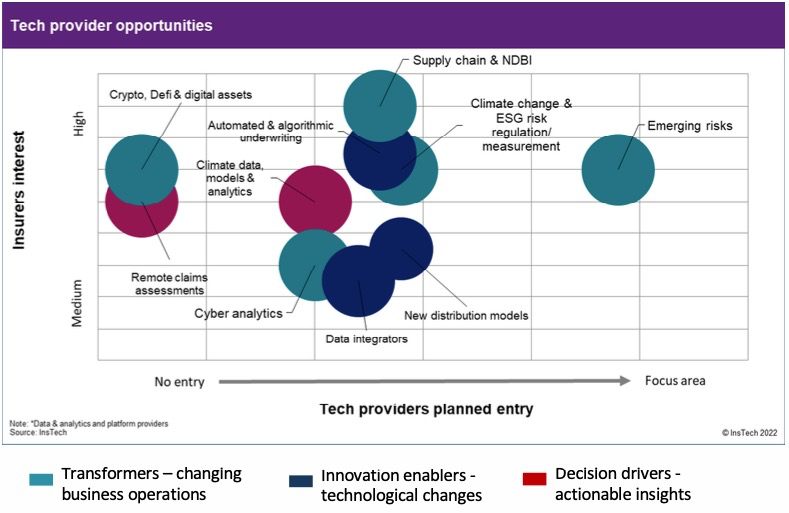

- Over 80% of insurers still seek more knowledge across various areas of underwriting and claims.

- Crypto and supply chain/Non-physical Damage Business Interruption (NDBI) have the most significant provision dissatisfaction.

- Education gaps persist in areas like climate change & Environmental, social, and corporate governance (ESG) risk, supply chain & NDBI.

Addressing the Opportunities and Challenges

To capitalize on the opportunities and address the challenges highlighted in the InsTech survey, industry players must focus on the following:

- Enhancing Knowledge and Education: InsurTech providers should invest in educational resources and support for insurers to help them better understand complex topics such as underwriting, claims processing, climate change & ESG risk, and supply chain & NDBI. InsurTech companies can empower insurers to make informed decisions and drive industry innovation by offering comprehensive training and knowledge resources.

- Bridging the Provision Gap in Crypto and Supply Chain/NDBI: InsurTech providers should focus on expanding their offerings to address emerging areas of interest, such as crypto and supply chain/NDBI. Developing new data sources and tools that cater to the unique requirements of these sectors will ensure insurers can provide comprehensive coverage to their customers and close the protection gap.

- Addressing Education Gaps: InsurTech providers must work closely with insurers to help them understand complex subjects, such as climate change & ESG risk and, supply chain & NDBI. By providing educational resources and support, InsurTech companies can help insurers navigate these challenges and foster innovation and growth in the industry.

The Future of InsurTech

As the InsurTech landscape evolves, industry players must stay in tune with emerging trends and address the challenges and opportunities identified in the 2023 InsTech Insurance Innovation Member Survey. By enhancing knowledge and education, bridging the provision gap in crypto and supply chain/NDBI, and addressing education gaps, InsurTech providers can help insurers stay ahead of the curve and revolutionize the industry.

To learn more about the 2023 InsTech Insurance Innovation Member Survey and its implications for the future of InsurTech, check out the full report at the Instech website.

#InsurTech #InsuranceInnovation #Crypto #SupplyChain #NDBI #ClimateChange #ESGRisk

No Comments Yet

Let us know what you think