Insurance Advisernet (IAN), a leading broking network with over 250 insurance advice practices across Australia and New Zealand, has released its 2023 Insurance Landscape Report. The report highlights insurance buyers' challenges in both countries due to persistent inflation, extreme weather events, and ongoing supply chain disruptions, impacting insurance premiums and market capacity.

Over the past decade, IAN has observed a steady increase in the average cost per claim, a trend worsened by three years of supply chain issues that began in 2020. Significant delays in the supply of materials, white goods, and vehicles have hindered rebuilding efforts and claim settlements, affecting insurance market conditions.

The COVID-19 pandemic has contributed to these challenges by causing a sharp increase in global demand for goods as consumers shifted from in-person services. However, the global supply chain has struggled to accommodate this surge in demand due to the lengthy process of expanding shipping capacity. As a result, freight prices have skyrocketed, leading to higher costs for importers, inflationary pressures for consumers, and reduced margins for businesses unable to pass on those costs.

In recent years, extreme weather events have become more frequent in Australia, such as last year's Queensland and New South Wales flooding. New Zealand has also faced severe weather events, with the Auckland Anniversary storms and Cyclone Gabrielle causing significant damage to the North Island. These events have exacerbated the already challenging insurance market conditions for insurance buyers in both countries in 2023.

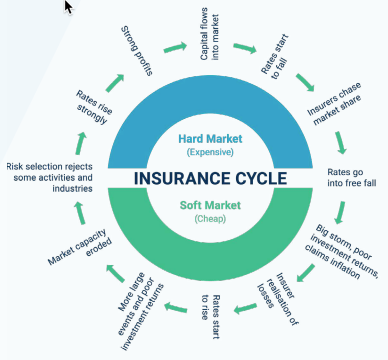

Looking ahead, IAN forecasts the following trends in the insurance market:

Insurance buyers in Australia and New Zealand should be prepared for these challenging market conditions and consider working closely with their brokers to develop effective risk management strategies that can help mitigate the impact of rising insurance premiums and reduced capacity.

These Stories on insurance

Copyright © 2023 InsuredHQ Limited. All Rights Reserved - InsuredHQ Privacy Policies - Glossary

No Comments Yet

Let us know what you think