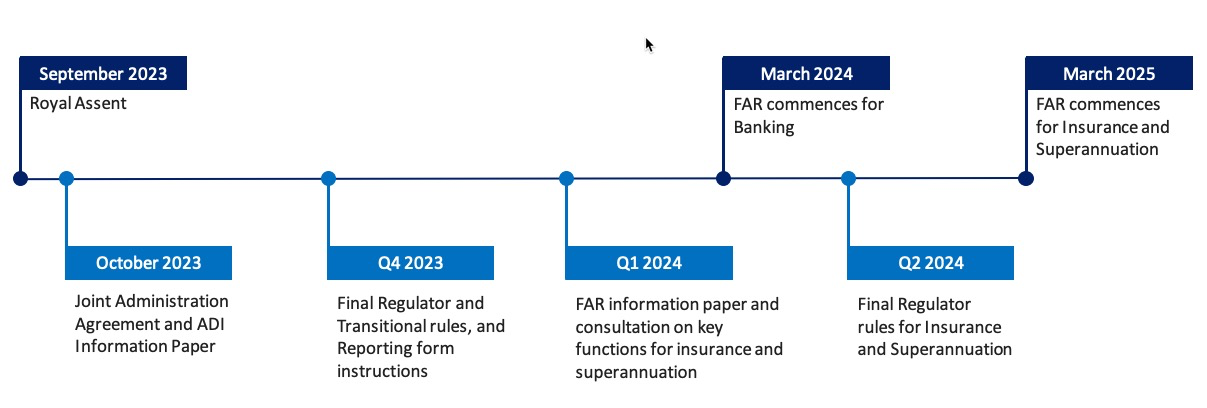

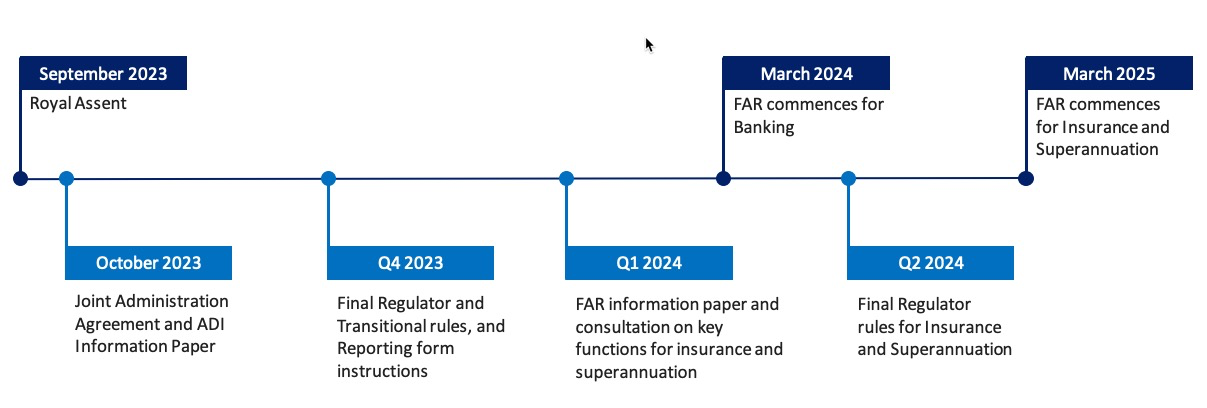

Passed into law on September 14, 2023, the Financial Accountability Regime (FAR), a legislative evolution from the Banking Executive Accountability Regime (BEAR), broadens its scope beyond banking to include the insurance industry, signaling significant shifts for Australian insurance carriers.

FAR is set to shift how all financial institutions function significantly, and the regime will come into effect on March 15, 2025. At InsuredHQ, we understand the challenges and opportunities this presents for our clients and the broader Australian insurance community. Therefore, we are committed to helping you navigate these changes effectively.

Key Obligations for Insurers Under FAR.

For insurers, FAR delineates a set of core obligations:

- Accountability: Insurers must ensure that business is conducted with integrity and prudence, compliance with regulatory standards, and upholding a reputation of honesty and reliability.

- Key Personnel: It is mandatory to identify and register accountable persons within your organization. These individuals are responsible for substantial facets of your business and for maintaining operational integrity.

- Deferred Remuneration: A significant part of your strategy should involve revising remuneration structures. At least 40% of variable remuneration for accountable persons must be deferred, aligning financial incentives with long-term outcomes and responsibilities.

- Notification: Swift and transparent communication with regulators regarding any significant changes or breaches within your organization is now more crucial than ever.

SOURCE: Financial Accountability Regime, Deloitte Sep 2023

Preparing for FAR: Steps for Insurers

The transition to FAR compliance is a marathon, not a sprint. Here are some key recommendations to prepare:

- Understand FAR Inside Out: This may be obvious, but insurers must become familiar with FAR's obligations and timelines. Review these guidelines provided by ASIC and APRA, especially the recently released RG 279, to grasp the specifics of accountability statements, maps, and significant related entities (SREs).

- Map Your Accountability: This is a big part - Conduct thorough internal reviews to define clear lines of accountability within your organization. This involves delineating responsibilities and ensuring they are well-documented and understood across all levels.

- Revise Remuneration Policies: Align your remuneration strategies with FAR's deferred remuneration obligations. This ensures compliance and ties financial rewards more closely to long-term performance and ethical conduct.

- Develop a Notification Framework: Establish protocols for timely reporting to regulators, ensuring you can effectively meet the 30-day notification requirement. (InsuredHQ has extensive reporting capabilities to help our customers achieve this)

- Train Your Team: Implement comprehensive training programs. Ensure everyone, especially your accountable persons and those involved in compliance and governance, understand FAR's implications and their roles within it.

- Engage with Technology Solutions: As a leader in insurtech, InsuredHQ is committed to providing solutions that support compliance with FAR. Our software is designed to support complex products and industry-specific reporting, which can be instrumental in managing the transition.

- Consult and Collaborate: Engage with legal advisors, consultants, and tech providers like InsuredHQ. We're here to help streamline your processes and ensure you remain on the right side of regulatory compliance.

Looking Ahead

As the March 15, 2025, deadline approaches, proactive preparation will be key to navigating the complexities of FAR. At InsuredHQ, we believe in empowering our clients through technology and insight, ensuring that you're not just compliant but also competitively positioned in the evolving insurance landscape.

The process of becoming FAR compliant is ongoing. It is crucial to remain informed and flexible as you navigate this new regulatory environment. If you require further assistance or have any questions regarding how InsuredHQ can help you with your transition to FAR compliance, please do not hesitate to contact us.

No Comments Yet

Let us know what you think