As an insurance industry software platform, InsuredHQ recognizes that the COVID-19 pandemic has challenged how insurers operate and highlighted the urgent need for digitization.

What used to be a question of "why digitize?" has now become "how can we digitize quickly?" yet digital transformation remains the biggest challenge facing insurers.

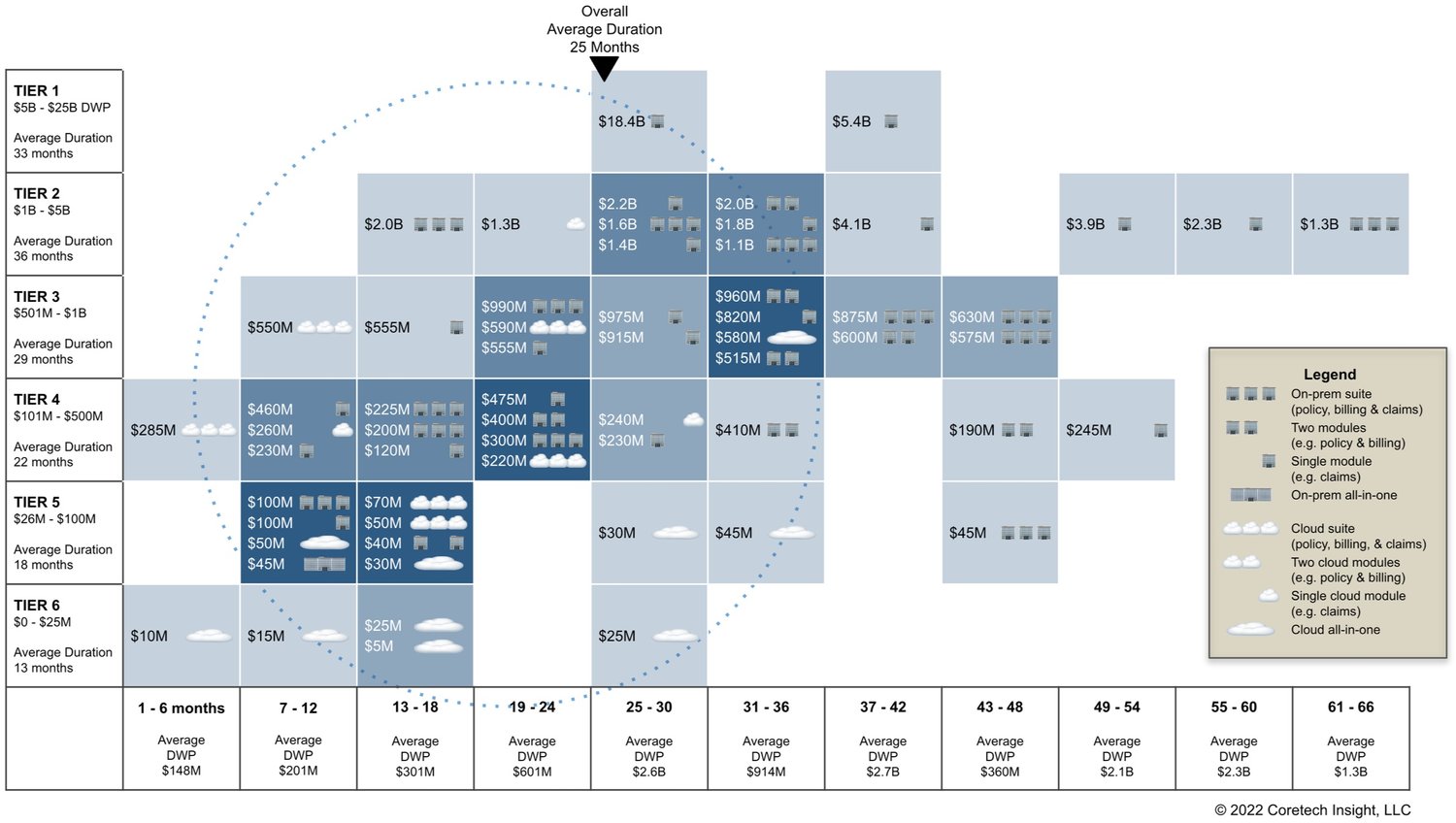

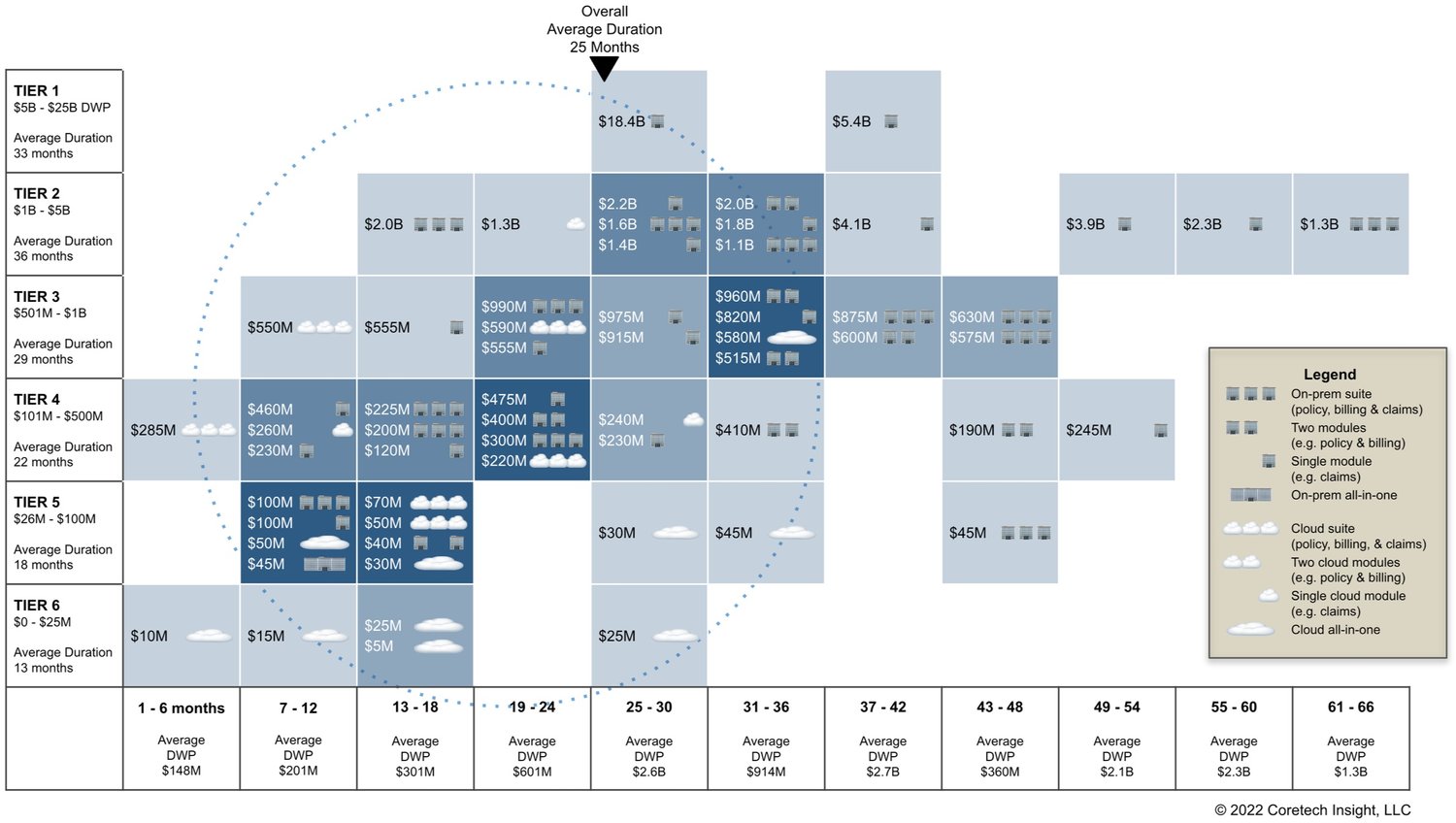

Insurers typically take 1.5 to 5 years to implement a new core system, and 80% of these projects fail. As a result, insurers continue to face the same challenges as does the markets they serve.

Source: Coretech Insight, May 2022

The pandemic has forced insurers to quickly adapt and learn new skills, behaviors, technology, processes, and customer interaction methods. Insurers have had to handle this pressure while ensuring they do not fall over. The insurance industry has a history of this kind of resilience and will continue to overcome every obstacle. But we have to start doing it faster.

As the demand for insurance products increases, insurers must adapt rapidly to keep up with changing behaviors and the effects of climate change and global pandemics. In addition, many insurance companies have had to adopt remote working and internal collaboration tools due to internal social changes such as new work-from-home policies.

Prior to the pandemic, many insurers had traditional technology stacks, including a core policy administration platform, a separate underwriting solution, a finance/actuarial system, and a digital distribution solution for intermediaries such as brokers. All of which interact together poorly and slowly.

Post-pandemic insurers are under pressure to quickly redesign and develop their core back-office platforms to remain competitive and relevant. This means bringing features and processes in a more centralized, coherent, and automated way to meet the changing requirements and demands of the future of insurance and our planet.

At InsuredHQ, we see this accelerated need for digital transformation in the insurance industry daily. Our customers realize that they must adapt quickly to changing market conditions, staff needs, and customer expectations while keeping up with climate change's effects and global pandemics.

By embracing digital transformation and investing in modern and resilient technology platforms, insurers can achieve greater efficiencies while remaining competitive and driving new revenue.

No Comments Yet

Let us know what you think