In a world increasingly driven by technology and digital interconnectivity, the integrity and safety of our financial systems have never been more crucial. As regulators race to keep pace with evolving cyber threats, the Australian Prudential Regulation Authority (APRA) recently released a comprehensive report detailing the country's financial institutions' cyber resilience, including insurers. Below are some highlights of these findings, highlighting the urgent areas of improvement and their implications for the insurance sector and beyond.

Key Findings by APRA

- Identification and Classification of Information Assets: Many entities must appropriately identify and classify their critical and sensitive information assets. The main culprits were the need for more clarity in classification policies and infrequent updates to asset registers.

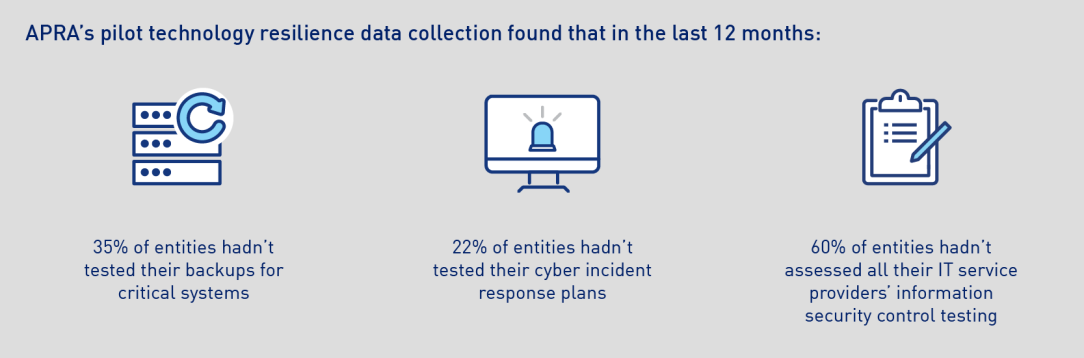

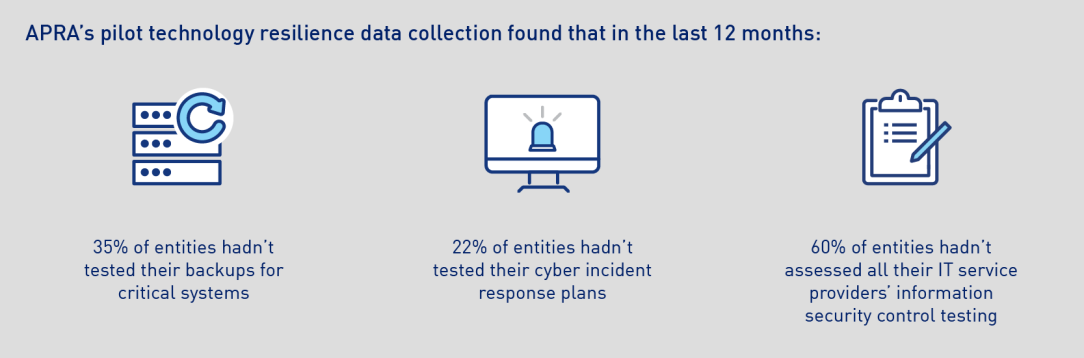

- Third-party Information Security: With increasing outsourcing to third-party service providers, there's a growing concern regarding the adequacy of their security controls. Many entities based their assessments solely on third-party self-assessments without any independent verification.

- Control Testing Programs: Systematic testing of information security controls revealed inconsistent and inadequate programs across entities. Many needed the requisite independence and offer sufficient assurance to management and boards.

- Incident Response Plans: These plans, pivotal in responding to potential breaches, lacked depth, testing frequency, and scenario coverage.

- Internal Audit Reviews: Many entities had limited reviews of third-party-operated security controls, and often, internal auditors needed more skills for rigorous control testing.

- Notification Protocols: Consistency in identifying and reporting significant incidents and control weaknesses to APRA was missing, indicating an urgent need for clearer governance processes.

What This Means for the Insurance Industry

While these findings cover a spectrum of financial institutions, their implications for insurers are profound:

- Customer Trust: Cybersecurity isn't just about risk management; it's also about trust. Ensuring data safety is paramount to maintaining and building trust with policyholders.

- Regulatory Compliance: APRA's CPS 234 standards set a clear bar. Institutions that fail to meet these standards might face regulatory repercussions, affecting their operational viability.

- Operational Continuity: Cyber threats can disrupt operations, leading to service interruptions, a damaged reputation, and significant financial losses.

Moving Forward with APRA's Recommendations

In light of these findings, entities, especially insurers, should prioritize the following:

- Clearer Asset Classification: Regularly updating and refining asset classification can significantly enhance data protection measures.

- Rigorous Third-party Audits: Rather than relying solely on self-assessments, entities should perform independent checks on third-party security measures.

- Enhanced Testing Protocols: Instituting regular, independent testing programs will ensure controls are consistently adequate.

- Refined Incident Response Plans: Annual testing and reviews can ensure these plans are always fit-for-purpose.

- Skilled Internal Auditing: Upskilling internal auditors and ensuring rigorous reviews, especially of third-party controls, can bolster security.

While APRA's report paints a concerning picture of the current state of cybersecurity in the financial sector, it also offers a roadmap for insurers to follow during digital transformation efforts.

As cyber threats continue to evolve, institutions must stay ahead of the curve, prioritizing security as a compliance measure and an integrated cornerstone of their operational strategy, similar to DevSecOps practices in Software Development. As a leading provider of core software administration platforms for insurance businesses, we at InsuredHQ are acutely aware of the criticality of robust cybersecurity measures and trust.

#APRA #Cybersecurity #CPS234 #InsuranceIndustry #InsuredHQ #StaySecure

No Comments Yet

Let us know what you think