The "Financial Stability Report," published this month by the Reserve Bank of New Zealand, outlines the risks to financial stability in New Zealand. The document is a requirement under the Reserve Bank of New Zealand Act 2021. It contains strategic priorities and actions to strengthen the regulatory framework and manage systemic risks amidst a global environment of persistent high core inflation and tight monetary policy.

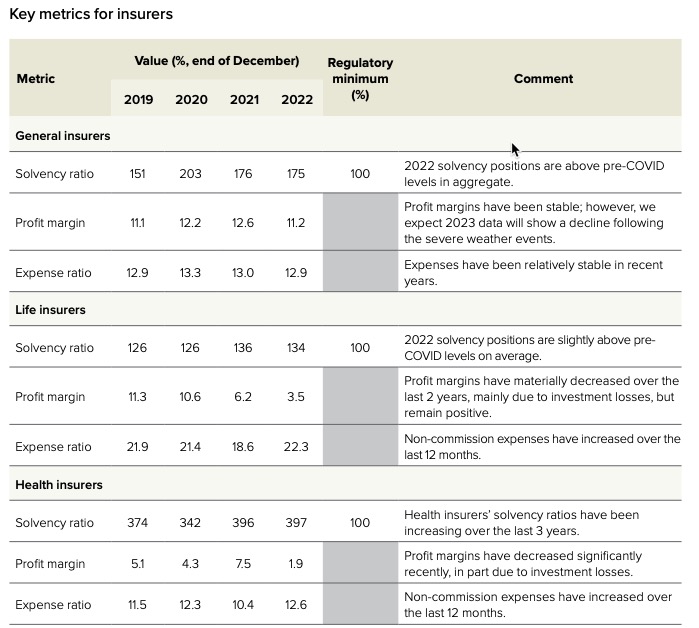

According to the report, the New Zealand insurance industry remains resilient despite various challenges. Insurers have maintained robust solvency positions well above regulatory requirements despite substantial operational strains. This resilience has been demonstrated through the industry's ability to withstand shocks, including the severe weather events of this year and significant investment losses due to rising interest rates.

However, the industry has experienced a difficult period. General insurers saw a substantial decline in profitability due to the severe weather events, and life insurers have also experienced reduced profitability over the last two years, attributed to investment losses due to rising interest rates.

The report highlights the impact of increasing reinsurance costs, driven by a global trend of reinsurers reducing risk appetites and re-evaluating risk following significant weather-related losses in Australia and New Zealand. This increase has led to a sharp rise in property insurers' premium rates and necessitates insurers to hold more capital due to the increased exposure net of reinsurance.

The operational strain has also been noted, particularly for property insurers, where claims volumes for home contents and motor vehicle policies have been significantly higher than usual. The report draws parallels to the aftermath of the Canterbury earthquakes, suggesting that decisions on land zoning and remediation, along with local flood risks, will likely delay the finalization of affected insurance claims. Consequently, the report anticipates lasting financial system effects, including changes to insurance availability and a greater adoption of risk-based pricing.

Cyber risk remains a significant concern, with the report noting ongoing cyber-attacks across the financial sector, including insurers. The Reserve Bank of New Zealand emphasizes the importance of cyber resilience and is increasing its monitoring of cyber risks and incidents across all supervised firms.

The emphasis on cyber resilience aligns with the need for robust cybersecurity measures within the insurance administration software and platforms provided by such businesses as InsuredHQ. Our services, including our flexible and scalable core insurance administration software and Open APIs, are critical in supporting general insurance carriers, agents, and startups to navigate these industry-wide challenges.

These Stories on insurance

Copyright © 2023 InsuredHQ Limited. All Rights Reserved - InsuredHQ Privacy Policies - Glossary

No Comments Yet

Let us know what you think